Get Top Dollar for Your Home with These 11 Tips

Almost every home seller I meet with starts the conversation with a statement and then a question. First they let me know that they want to get top dollar for their home. I want them to get top dollar too! Second, they ask me what they need to do to get their home ready to list. Since this question gets asked so frequently, I thought I’d write it all down. In this blog, I’m sharing 11 tips to help home sellers get top dollar in any market.

Keep reading or click the YouTube video below to see real-life examples of home preparation best practices.

Tip #1 : It All Starts with Mindset

Commit to setting aside your personal preferences and how you live in your home, and put yourself in the position of the person who will likely buy your home.

Why? Because In order to sell your home for top dollar, you want buyers to have a complete sensory experience so that they can see and feel themselves actually living in your home.

Here’s how to do that…..

Tip #2 : Merchandising Your Home Brings Top Dollar

If you’ve lived in your home for a while, you’ve probably accumulated a lot of stuff. Haven’t we all? Plan on clearing out quite a bit of it.

For example, which closet do you think would most appeal to a prospective buyer?

Let’s look at another area of the house. What about these bathroom vanities? Which do you think would be more appealing to a prospective home buyer?

When it comes to closets, bathroom cabinets and drawers, your pantry, and kitchen cabinets and drawers, plan on removing about two-third of the items currently stored in these areas if they’re packed with stuff, or get it organized in an orderly way.

Tip #3 : Decluttering is Essential

Next, go room by room with your agent to determine which pieces of furniture stay, which should be relocated to another room, or which should be removed completely. Why? Because you want to get top dollar. And in order to achieve that, the buyer has to be able to see how a room can be arranged and to get a sense of spaciousness. We don’t want them to have to guess where furniture goes or to have to look past all of your stuff.

Here’s an example of a living room that’s clean and well kept, but too cluttered. There are too many plants and items on the bookshelves, and the end table that’s front and center in the photo, should have been removed for this photo. It’s drawing attention away from the actual spaciousness of the room.

And here is an example of a living room that has been decluttered.

This is actually a house that I listed and sold, on Yorksprings, after it had been unsuccessfully listed by another agent. The seller removed a giant hutch that was in the dining area, and two of the chairs around the dining room table. They also removed an additional couch that was in the living area. These changes made a huge difference and made the house feel more spacious.

Need more tips on decluttering your home? Check out the blog about decluttering that I posted a while back.

Tip #4 : What about the kids’ rooms?

Let’s take a minute to talk about kids bedrooms and play rooms. I understand that moving can be a big adjustment for your kiddos and most parents want as little disruption to their kids’ lives as possible. What I recommend is clearing out the clothes they no longer fit in, and the toys they no longer play with. And plan on having their rooms staged for the property photography.

Here’s a listing photo from a property that I sold on Gatewood. The seller really went above and beyond staging her house and this is how her son’s room turned out. Isn’t it adorable? Can you see how this level of detail could help a prospective buyer fall in love with this room? This seller got top dollar for their home.

If you can have their rooms totally cleaned and picked up for showings, great. But I think that most people can look past a few toys being left out when they come and view a property.

Before we go much further, let me address another common question that I get from home sellers.

Tip #5 : What to do with your stuff…

Sellers always want to know if they can store items in the garage while their house is on the market.

Yes! It is 100 percent okay to store boxed up stuff in your garage. In fact, it’s preferable to storing items in your formal living and dining areas, like this.

If you were looking to buy this house, do you think that you could remotely tell what size furniture you could get in this room, or how you would arrange it? Does this image evoke any kind of warm and fuzzy feeling about buying it and making it your home? Do you think that this seller is going to get top dollar?

Tip #5 : Break out Mr. Clean

I once worked with an Ebby agent who said, “Robyn, if I can smell it, I can’t sell it!”

It was funny when she said it, but it would not be fun to do all this work to get your home ready for the market, and then have potential buyers walk away because they’re not sure about a smell or cleanliness.

So, now that you’ve got things cleared out and moved around, it’s time for a deep clean. If you don’t like to clean, I get it. I don’t like to clean either. If that’s the case, or if you don’t have the time, arrange for a have a service come and do a deep clean for you.

Tip #6 : Don’t Forget About the Exterior

The front yard is the first thing buyer’s see when they come to your home.

It’s a good idea to clean up the flower beds and freshen up the landscaping. Black mulch in your flower beds will really make your home pop in listing photos.

Put a fresh coat of paint or finish on the front door if it’s looking worn. Again, this the buyer’s first experience of your home. It needs to look and feel inviting.

Don’t forget about the backyard either. Get the landscaping cleaned up and dust off the patio or pool furniture.

Tip #7 : What About Mechanicals?

We live in Texas. Our HVAC gets a workout whether it cranked down to keep the house cool in the summer, or cranked up to stay warm in the winter.

I don’t think I’ve ever seen an inspection report where the inspector didn’t cite one or more deficiencies with the HVAC. Therefore, it is ALWAYS good idea to have your HVAC cleaned and serviced prior to putting your house on the market.

Tip #8 : The Dreaded Seller’s Disclosure and Repairs

It’s also a good idea review the Seller’s Disclosure Notice while you’re putting together your list of things to do to get your home ready to list.

This is a very detailed document that home sellers in Texas are required to provide to home buyers. It lists almost every single aspect of your home including the roof, plumbing, electrical, foundation, HVAC, insurance claims and more. Seller must check off if the items are in working order or in need of repair. You can also add detail if there are items that have been recently repaired or updated.

If there are items that are in need of repair, I recommend that you address them. Why?

Because home buyers typically estimate that repairs will cost about 3 times as much as they cost in real life. When they see items that need to be repaired, in their minds, they are deducting those perceived costs from their offer price.

Remember, I also work with buyers and I have seen them do this with my own eyes.

The bottom line is that you want top dollar. Do not want to give buyers a reason to submit a low ball offer.

Tip #9 : Professional Staging Brings Top Dollar

If you’ve already moved into your new home, plan on having your previous home professionally staged rather than leaving it vacant. The most important rooms to stage are the living and dining areas, the primary bedrooms, and have the kitchen and bathroom accessorized.

The reason I recommend staging is because you want prospective buyers to get a sense of how they could arrange furniture and live in the space. Also, a staged property feels more like a home than a vacant property.

These images are from a home that I sold on Farrar in 2022. The seller had vacated the property and had it professionally staged.

Now, You may be thinking to yourself that this all sounds expensive.

Staging can be expensive if you work with someone who has to rent the staging furniture, but if you work with a stager who owns their own furniture, it can be quite affordable and deliver an excellent return on your investment.

Tip #10 : Know the Competition

There is nothing wrong with being a nosy neighbor when you are preparing to sell your home. If we are working together, we will go and look at other home that are actively being marketed for sale in your neighborhood. Sellers need to see for themselves what the competition has working for and against them.

If you’re not working with me, be sure to go with your agent and view competing properties in your neighborhood.

Tip #11 : Professional Photography is a Must

Confirm that your agent will be working with a professional photographer to shoot the photos of your home.

People eat with their eyes first, if a buyer doesn’t like what they see in the MLS photos, they will not come see it in person.

I am honestly offended when I see properties listed without professional photos. Professional photography is quite affordable and it makes a HUGE difference in marketing the home for sale.

Now that you know what you need to do to prepare your home for sale to get top dollar, you might be interested in finding out how to get into your next home with as little disruption to your life as possible.

Until next time…..

Lochwood Market Update: December 2022

Once again, you can either watch the update on a video, or scroll down and read for yourself. Enjoy!!

If you try to stay up to speed on what’s going on with the real estate market, you may be unsure which sources you should trust. After all, the national media would have you believe that the real estate sky is falling. Local publications print conflicting headlines and information, sometimes within the same issue. So, who should you trust and what should you believe? The truth is that real estate is extremely hyper-local and time-sensitive, so it’s best to weight local analysis over national analysis. Let’s dig into November sales in Lochwood, along with sales that will be closing soon, and what’s going on with the homes currently listed for sale, so that you have the most up to date and accurate information about our neighborhood.

Be sure to read all the way to the end for an important update about 2023 property tax rates.

Looking Back: November Sales in Lochwood

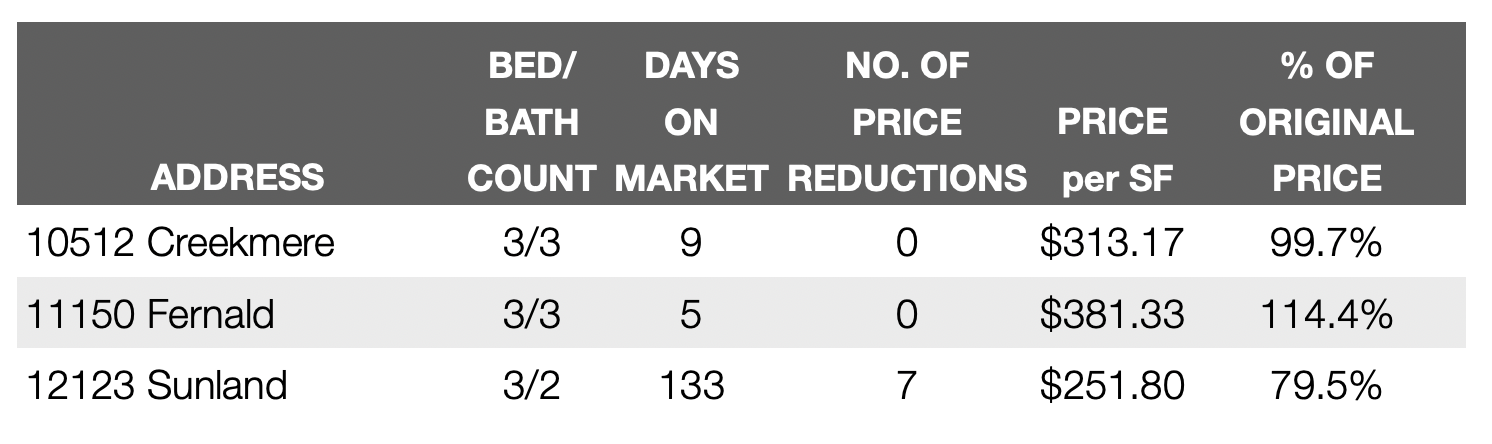

The below details all of the Lochwood homes that sold in November 2022. In all, there were 3 sales. One of these homes sold for 100 percent or more of the seller’s original list price (far right column). For the purpose of comparison, in November of 2021, there were 7 total sales and 4 of those homes sold for 100 percent or more of the seller’s original list price.

November 2022 was an interesting month for home sales because we recorded both the highest and lowest sale prices of the year. 12123 Sunland sold for the lowest price of 2022 while 11150 Fernald sold for the highest price of the year. The home on Fernald is Mid-Century Modern architecture, which ALWAYS sells for a premium. Additionally, this home sits on a very secluded and heavily-treed 1.3 acre lot. It’s truly one of a kind.

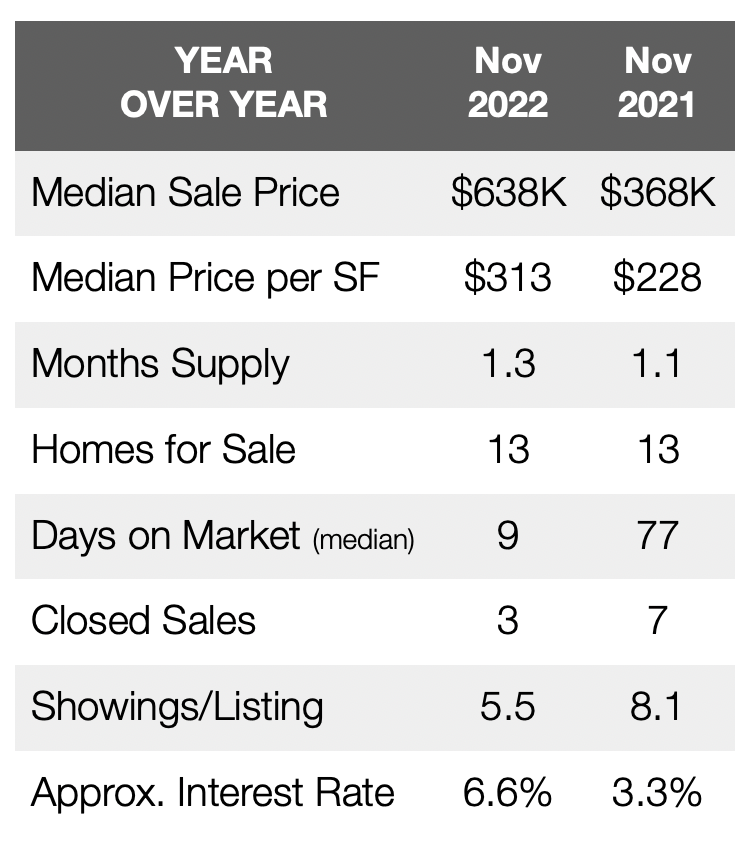

Looking Back: Year-over-Year at a Glance

The next table below gives you a snapshot of how the market performed in November of 2022 compared to the same time last year. Once again, overall sale prices for 2022 remain higher than the sale prices of 2021. It still cost a home buyer twice as much to borrow money for their mortgage: however, interest rates did start to drop in November. In fact, mortgage interest rates have dropped for three consecutive weeks. As of the first week in December, a well-qualified home buyer could secure a 30-year, fixed-rate mortgage for 6.125 percent. Analysts believe that interest rates will settle at about 6 percent if inflation continues to drop.

What’s Happening Right Now in Lochwood? Pending and Active Listings

There are currently three home sale pending in Lochwood. One of the homes pending sale is 10815 Meadowspring. FINALLY! I’ve been writing about this listing for some time now. It was originally listed in the summer for $1.1M. Last month it was re-listed by a different agent for $750,000. After 25 days at that price, it was reduced to $649,000 and finally went under contract.

Looking ahead, I anticipate that we will see fewer sales in December 2022 than we did in December 2021 when 12 homes sales closed. December will likely be the second consecutive month with fewer sales, year-over-year.

There are currently 14 homes listed for sale in Lochwood. That’s the same number of homes that were actively marketed for sale in November. Prices for these listings range from $359,000 to $1.2M. Ten of these listings have had one or more price reductions. 10556 Evangeline Way has been reduced by $125,000. Click here to view homes that are currently on the market in Lochwood.

Key Take-Aways

-

- Interest rates have dropped for three consecutive weeks and analysts now believe that rates will settle around 6 percent if inflation continues to decline.

- Despite lower interest rates, we will likely see buyers continue to ask sellers for a contribution toward their closing costs so that they can buy down their interest rate even lower.

- If a home hasn’t sold, and the property has been on the market longer than the average or median days on market, then the seller should consider offering funds toward the buyer’s closing costs so that prospective buyers can buy down their interest rate. The reason that this is an effective strategy for sellers is that helping the buyer attain a lower interest rate is actually more cost effective than lowering the list price of the house. I’ll discuss this in greater detail next month.

- 2022 sale prices are still significantly higher than 2021. I anticipate that the appraisal district will increase most homeowners’ market value assessment by the full 10 percent in 2023. Ten percent is the maximum amount your value can increase if you have a homestead exemption on your property.

- Our property tax rates have been set at 2.51 percent. This rate is lower than what Lochwood homeowners have paid for the past two years. Yay!!!

Thank you for your time! I hope you’ve found this post to be informative and helpful if you are considering buying or selling a home in Lochwood. If you’d like this update sent to your email every month, send me an email at robyn.price@cbdfw.com to let me know. You can also send me any of your other real estate related questions. I will always respond, and may even include it in a future update.

Have a wonderful holiday season!

9 Tips to Avoid Buying a Flip that’s Lipstick on a Pig

You think you’re ready to buy a house in East Dallas and you know you want one that’s already been remodeled because either you don’t know the first thing about home improvements or, if you do, you really don’t have the time for a big project. You need a home that’s turnkey, or move-in ready, and you’ve heard nightmares about people buying remodeled homes that looked good, but it turns out that the remodel work was actually subpar.

In this video, I’m going to share 9 tips to help you avoid buying a home that’s just lipstick on a pig so that you feel more confident about going and looking at houses, and talking to the inspector about their findings once you have the house under contract.

Be sure to watch or read to the end because the last tip I give is actually the one that’s the most empowering for any home buyer.

Tip #1

Ask your agent to look at the MLS history on the house. This will give you an idea of when the current owner purchased the home and how much time they actually put into the remodel work. Looking at previous listings in MLS also helps you to see what the condition of the home was like before it was remodeled.

Tip #2

Carefully review the seller’s disclosure before viewing the house, or submitting your offer. Again, the seller’s disclosure is usually posted in MLS and can be easily accessed by your agent. You want to look for things like whether or not the seller has actually lived in the house. Has it ever had foundation work? If so, who did the work and is there a transferable warranty associated with that work? Was any of the work done with or without permits from the city? Most importantly, if the seller purchased the home within the last 5 years, they should provide the inspection report from their purchase. Read it!

Tip #3

Run a search through the City of Dallas website to see the permit history on the home. Information on any permits pulled for work on any property are posted for public consumption. Click here to search permits in Dallas by property address. You’ll not only see when the work was done, but also the vendor who did the work, and the estimated value of the work.

Tip #4

Know that most work that is done on homes in Dallas is not permitted. If you do find a property where the electrical, plumbing, HVAC, roof or any other work was permitted, then know that you’ve found a unicorn and you should probably consider looking at it. If the work was permitted and the permit was closed out, that means that work has been done to meet current code. Again, congratulations, you’ve found a unicorn!

Tip #5

If what you can see with your eyes doesn’t look good, then what you can’t see with your eyes probably wasn’t done well either. I’m talking about the stuff that’s behind the walls, or in the attic or crawl space. Don’t be afraid to walk away. Your agent can also submit feedback to the seller that the work just doesn’t pass the smell test.

Tip #6

Once you have the house under contract, work with a good general inspector. When you book the appointment for the inspection, let the inspector know everything that you know about the house. Share the seller’s disclosure, previous inspection reports and any information about permits with them. Please make sure you also share any concerns that you have about the property so that they can look at those items in greater detail.

Tip #7

Plan on attending the inspection recap. This is crucial because it’s your chance to ask the inspector any questions you might have about the property. It’s also a time where you can physically see what the inspector is referring to in their written report. You need to have a clear understanding of their findings.

Tip #8

Don’t just go off what the inspector says. If you feel like you need to have an electrician come out to examine the electrical system, book that appointment. If there are issues with the plumbing, have a plumber come out. This is helpful for a few reasons. First, the inspector is a general inspector. They are usually not experts on one or more of the systems in the house. Second, if there is additional work that needs to be done, the expert who is looking at the electrical or plumbing can provide you with an estimate of what does need to be done, and you can present that information to the seller when you negotiate repairs or ask for a financial concession in lieu of repairs.

Tip #9

Don’t be afraid to walk away if you think the house has more issues than you want to deal with, or what you’re capable of dealing with, or if something just seems off to you. I guess what I’m saying here is to trust your gut. You’re the one who will have to live in this home and pay for any future repairs, not your agent. If it doesn’t suit your needs or standards, walk away.

Now that you know what to look for when purchasing a home that’s already been remodeled, you may want to check out some of my other blogs and videos that focus on buying a home and public schools around White Rock Lake.

Now that you know what to look for when purchasing a home that’s already been remodeled, you may want to check out some of my other blogs and videos that focus on buying a home and public schools around White Rock Lake.

Thanks for stopping by! Please contact me with your comments and questions. I will respond! And stay tuned for more information that’s meant to empower home buyers and sellers throughout the Dallas area.

Lochwood Market Update : November 2022

If you try to stay up to speed on what’s going on with the real estate market, you may be unsure which sources you should trust. After all, the national media would have you believe that the real estate sky is falling. Local publications print conflicting headlines and information, sometimes within the same issue. So, who should you trust and what should you believe? The truth is that real estate is extremely hyper-local and time-sensitive, so it’s best to weight local analysis (not just sensationalized headlines) over national analysis. Let’s dig into October sales in Lochwood, along with sales that will be closing soon, and what’s going on with the homes currently listed for sale, so that you have the most up to date and accurate information about the Lochwood real estate market. Be sure to read all the way to the end to learn the key takeaways from my detailed analysis.

Looking Back: October Sales in Lochwood

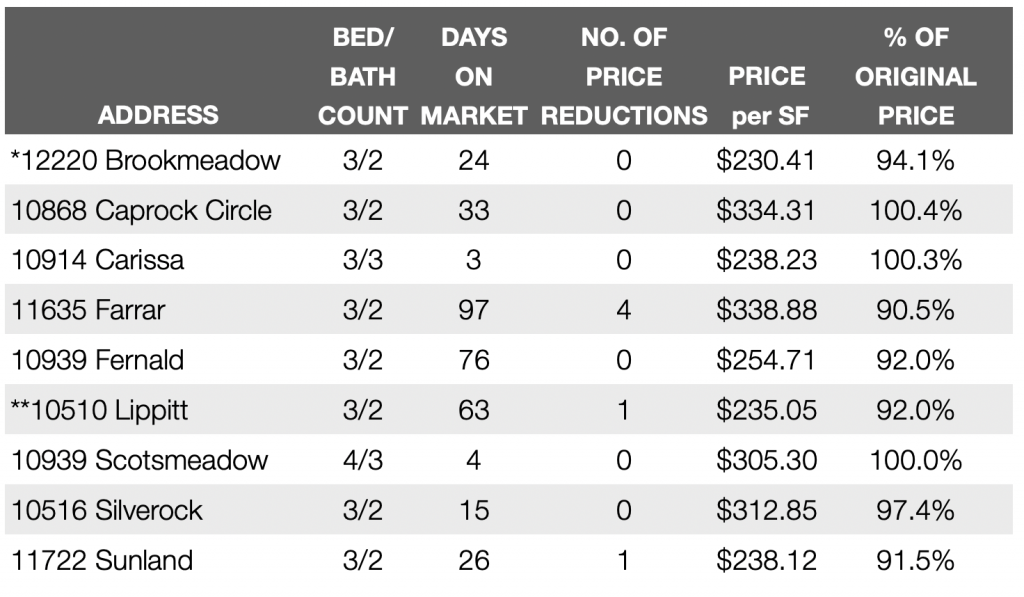

The table below details all of the Lochwood homes that sold in October 2022. In all, there were 9 sales. Three of these homes sold for 100 percent or more of the seller’s original list price (far right column). For the purpose of comparison, in October of 2021, there were 7 total sales and 5 of those homes sold for 100 percent or more of the seller’s original list price.

There were fewer price reductions for October sales than there were in September. The listing at 11635 had the highest number and dollar value of price reductions. In all, the list price of this home was reduced by $50,000 before going under contract.

*The listing at 12220 Brookmeadow originally came on the market priced at $350,000. I called the listing agent immediately to ask her why she had priced it $80,000 below what my listing two doors down had just sold for. From what I could tell, the two homes were quite comparable in terms of condition and size. The agent told me that she was from Arlington and admitted that she had a hard time pricing the house because she didn’t know the neighborhood very well. She ultimately raised the price, which resulted in the seller making $50,000 more than she would have had the house remained listed at $350,000. Yet another reason to work with agents who actually know the local market.

**I also listed the house that recently sold at 10510 Lippitt. Click here to get the full story on this sale.

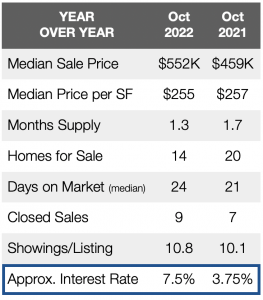

Looking Back: Year-over-Year at a Glance

The next table gives you a snapshot of how the market performed in October of 2022, compared to the same time last year. Besides the overall sale price being about 20 percent higher, the biggest shift in the market has been interest rates. In October it cost a home buyer twice as much to borrow the funds for their mortgage. That’s a significant change!

What’s Happening Right Now in Lochwood? Pending and Active Listings

There is currently one home sale pending in Lochwood. I anticipate that we will see fewer sales in November 2022 than we did in November 2021.

There are currently 14 homes listed for sale in Lochwood. Prices for these listings range from $359,000 to $1.25M. Nine of these listings have had one or more price reductions. 10862 Carissa has been reduced by nearly $100,000. 10815 Meadowspring was originally listed for $1.1M. It was relisted by a new agent in October for $750,000. It has had another $100,000 price reduction and is now listed for $649,900. Click here to view homes that are currently on the market in Lochwood.

Key Take-Aways

-

- Year-over-year, the number of homes sold is quite similar. That’s encouraging given how much interest rates have gone up. It indicates that buyers are still very interested buying homes in our neighborhood.

- Fewer homes selling for 100 percent or more of the seller’s original asking price indicates that there are fewer buyers competing to get these homes under contract.

- Price reductions indicate that sellers can no longer ask whatever price they want for their home. Buyers will wait for a price reduction so that the price comes in line with what they believe the value should be and what they are willing to offer for the property.

- Our market has gone from 100 miles per hour back down to the speed limit. For the time being, with the information currently available, our neighborhood market appears to be normalizing.

- If you decide to sell your home in the near future, it’s important to work with someone who really has a pulse on the market. I’ve sold several properties in the neighborhood in the past few months and I know that sellers need up to date information so that they feel confident walking away from low ball offers. There is a lot of that going on right now.

- Last week, interest rates dropped significantly. They’re currently hovering around 6.5 percent. The forecast is that this drop is temporary so I am surprised that we have not seen more homes go under contract.

Now that you’re up to speed on what’s happening in Lochwood, go back through this post and take a look at some of the links that I’ve included. That way you can see for yourself what’s on the market and get the lowdown on the sale at 10510 Lippitt.

Happy holidays and stay tuned for my final newsletter of 2021.

Success Story | 10510 Lippitt in Lochwood

This is a long success story about selling a Lochwood home, 10510 Lippitt, during summer and fall of 2022. As always, I will provide valuable information for home sellers and home buyers. If you happen to live in Lochwood and drive down Lippitt frequently, you’ll want to read this blog so that you can get the full story for yourself instead of relying on gossip from the neighbors. Get a cup of coffee or glass of wine because I’m about to give you the full lowdown. It’s going to take a minute! Please enjoy.

Getting to Know One Another

It all started in May of 2022 when I was contacted by the owner of 10510 Lippitt. He called in response to a postcard I had mailed asking homeowners if they know the true market value for their home. The owner told me that he wanted my opinion of value because he planned on selling the property soon. I asked a few questions, like I always do, and set a time to meet with him and his wife.

Meeting the Client

A few days later, we met in person. He walked me through the house so that I could see the floor plan and gave me a few more details about the condition of the home. He wanted to get right down to business so we sat down to discuss numbers. There were 3 very comparable sales within that past 90 days that ranged from $485,000 to $500,000. Because I know the neighborhood so well, and because I had spoken with him about the condition of the property before we met, I felt very comfortable telling him that this would be the price range in which his home would likely sell.

That’s when he told me that he wanted $580,000 for the house and that he wanted me to leave. I was shocked! I’ve had people disagree with me on value but I’ve never had anyone tell me that they wanted me to leave without any further discussion. Since we were so far apart on the value, I decided it was best to go. It’s not like we were $15,000 to $25,000 apart on a number. We were $100,000 apart.

Return of the Client

I walked away thinking that I would follow up in a few weeks, but that more than likely, he would end up hiring another agent who would tell him that $580,000 was a realistic price for the house, even though there was literally no data to support that value. If you’re surprised to hear that an agent would do that, don’t be. I see it happen all the time. There are agents out there who over promise and under deliver on a regular basis. I am not one of those agents. I do not mislead my prospective clients in order to win their business.

Low and behold, three weeks later I received another call from the home owner. He told me that he wanted to hire me and that the reason I was hired was because I had held my ground with him. We signed the paperwork immediately, and because he had already held an estate sale and vacated the property, it was listed immediately.

Know the Market, Likely Buyers, and their Tactics

I work with a lot of sellers who are the original and only owners of their home. That was the case with the seller of 10510 Lippitt. He and his wife had purchased the home from the builder in 1959 for $18,750. Can you imagine paying $18,750 for a 1900 square foot, 3-bedroom, 2-bath home with hardwoods throughout?! It’s kind of mind blowing.

The house had been very well maintained. The water heater, HVAC and roof were all newer, or less than 6 years old. The foundation appeared to be in good condition as was the exterior of the house. Today’s buyer would want to open up the floor plan and remodel the kitchen and bathrooms. How do I know this? Because I not only work with sellers, I also work with buyers of all ages and I understand their aesthetic preferences.

This type of home would typically sell to an investor who would flip it, or to an end-user who would update it themselves. End users who will update a home themselves are few and far between. Don’t get me wrong, they’re out there. They’re just not as common as investors and flippers.

Activity and Blind Offers

Activity on the property was a little slow the first couple of weeks. That was expected since it was listed right before the 4th of July and so many people travel to escape the heat during that part of the summer. While there weren’t many showings on the property, I was getting plenty of blind offers from investors.

What’s a blind offer? It’s when I randomly receive an offer via email from someone who has not actually visited the property. How do I know they’ve not visited the property? Because to access the property, buyers have to schedule a showing and I receive an alert every time a showing is scheduled. I can also check to see who accesses the electronic lock box. Yet another benefit to working with an agent – you know who is going in and out of your property!

Blind Offer Disadvantages?

What’s wrong with a blind offer? Well, there’s nothing wrong with a blind offer except that these people have no idea what they’re buying because they’ve not physically inspected the house. Usually they’re only running valuation models to determine what they can sell it for after its remodeled. It’s all a numbers game. Part of the numbers game is also knowing what you need to put into a house. I’ve worked with enough investors to know that you really need to walk a property in order to put together your remodel budget. For this property in particular, I knew there was value in the newer roof and mechanical systems, and that value should be reflected in any offer.

The other reason that I don’t put a lot of value on blind offers is because the buyers often fail to include proof of funds, or I cannot verify their pre-approval letter. Yes, buyers do have to “show me the money.” If a buyer can’t prove that they can close the transaction, then there isn’t much value in their offer. I’ve literally seen this hundreds of times.

Finding the Right Buyer

While I was fielding blind offers from Busch-league investors, I was also reaching out to investors who I knew had a good reputation and who could close the transaction. One new investor popped up on my radar. They had recently closed on a sale around the corner on Cimarec. I contacted the listing agent to get a feel for his experience of working with the investor and he said it had been good, so I decided to reach out on behalf of my client.

When I called, the investor’s representative answered the phone. That’s always a good sign! Seriously! You have no idea the number of agents I call who don’t answer their phone and when it rolls to voicemail, the message says that their voicemail is full. It’s annoying :/

I learned that this investor was interested in the property and that they were funded by Goldman Sachs. He told me about their process and scheduled a time to go and look at the property. Since I live around the corner, I decided to drive by during his showing to confirm that he did indeed look at it. A day or two later, I received a solid offer, with proof of funds to close. Seller executed the contract.

Moving Forward!

The buyer inspected the property and was satisfied with the condition of the home. In fact, he was so satisfied that he didn’t even ask for any price concessions or repairs. We prepared to move forward.

At this point, I wish that I could say that buyer and seller closed 21 days later and that everyone lived happily ever after, but that’s not what happened. Unfortunately, the buyer terminated the contract because the investment committee decided that they had too many properties in their pipeline and that they would have to hold the property longer than they originally anticipated. Side note: If there weren’t issues with the supply chain for materials, or a shortage of labor to work on these homes, the hold time would not have been impacted.

I put the property back on the market immediately.

Let’s Try This Again

The second time that the house came onto the market, there were a lot more showings and fewer blind offers. In fact, within a few days, I received a phone call from an agent who had showed the house. Her clients were end-users who were looking for a property to remodel for themselves. They were so interested in buying a home that needed to be remodeled that they actually viewed it with their contractor. To top it all off, they were pre-approved by a quality local lender, and their loan officer called me to tell me how great they were. The only hiccup was that they were getting a construction loan, so it would take 5 weeks to close, as opposed to a standard 30-day closing period.

I received their offer later that day. It was a good offer that was very much in line with the comparable sales that the seller and I had discussed at the end of May. Seller executed the contract.

Buyer had the property inspected. Again, it inspected well but they did ask for a minor concession and seller agreed.

Moving to Close

A week later, the appraiser came out to visit the property. I provided her with information on the house, and the list of comparable sales that seller and I had used to price the house. Side note: I almost always provide comps for appraisers, even when I know that the contract price is supported by recent comparable sales. There’s no need to leave it to chance and I consider it part of my job in representing the seller’s interests.

A few days later, I was notified that the appraisal met the contract value. Yay! Check off another milestone on the road to closing!

The following week I had the title company contact the buyer’s lender to confirm that lender was prepared to close. Lender confirmed that buyer had received the clear to close. Yay! The final milestone in the transaction process had been achieved. At this point, there were no “outs” in the contract process for the buyer.

Moving Backwards

Given that we were at the finish line, you can imagine how shocked I was when I received a phone call from the buyer’s agent, less than a week before closing, notifying me that the buyer wanted to terminate the contract. WHAT!? WHY?!

Apparently one of the buyer’s parents had a medical event and they just didn’t think that they would handle that while buying or remodeling a home. Honestly, seller would have been more sympathetic had we not learned that buyer still managed to take their 2-week vacation to Hawaii while their parent was still in Dallas recovering from this health issue.

At this point, buyer did not have a termination option based on the terms of the contract and seller was entitled to their earnest money or deposit. I cannot disclose what happened to those funds, but the buyer did terminate and I put the property back on the market immediately.

The Third Time is a Charm, Right?

The seller was obviously very disappointed at this point and I was concerned that he might fire me. Honestly, I’ve never had a house go under contract twice and not close. I’d never even experienced a buyer terminating a few days before closing.

Nonetheless, the house wasn’t on the market for long before it went under contract again. This buyer was also an end-user. She wanted to remodel the house for herself so that she could be near her children and grandchildren who lived in Old Lake Highlands. She was an experienced home owner, pre-approved by a quality lender, and she was motivated. In my 10-plus years of selling homes, I know that being near grandchildren is always a big motivator.

Uneasiness and Anxiety

Unfortunately, I started to feel uneasy about this buyer when she called me after the inspection to tell me all of the things that were wrong with the house. Wait, what? The house had been inspected two other times and there was one plumbing leak in the crawl space. When the buyer started acting as though she was going to have to have a major concession from the seller, I knew she was full of it and got in touch with the first buyer again.

I wanted to see if anything had changed with their pipeline and if they were still interested in the property. Indeed they were and a few days later I received another solid offer from buyer number one, the investor funded by Goldman Sachs.

I “encouraged” buyer number 3 to terminate her contract because seller was not going to give her one dime in concession. Buyer number one was back and was prepared to close!

Sale Closed and Funded

A few weeks later, seller closed the sale with buyer number one. This was a satisfying conclusion to selling 10510 Lippitt, and makes a great success story.

I have never had a property go under contract four times to three different buyers. I’m sure that crazier things have happened, but they’ve not happened to me….until now.

I am grateful that the seller trusted me and stuck with me. I have to believe that he saw how hard I was working on his behalf and that he knew I had no control over some of the issues that came up during the listing.

In hindsight, I think it’s easy to see that these things happen more when the market is in flux. Higher interest rates have buyers thinking that there is blood in the water and that sellers are desperate. The truth is that some sellers are more motivated than others. I encourage anyone who is selling their home right now to be patient. Make sure your agent knows the competition and that they are in contact with those listing agents to see what’s going on with their listings. That’s the real-time market intelligence that sellers need right now to make informed decisions about flakey buyers who think they’re going to be opportunistic. Not on my watch!

Be well and have a wonderful holiday season!

Lochwood Market Update – Oct. 2022

If you try to stay up to speed on what’s going on with the real estate market, you may be unsure which sources you should trust. After all, the national media would have you believe that the real estate sky is falling. Local publications, like the Dallas Morning News, print conflicting headlines and information, sometimes within the same issue. So, who should you trust and what should you believe? The truth is that real estate is extremely hyper-local and time-sensitive, so it’s best to weight local analysis (not just sensationalized headlines) over national analysis. Let’s dig into September sales in Lochwood, along with sales that will be closing soon and what’s going on with the homes currently listed for sale, so that you have the most up to date and accurate information about our neighborhood. Be sure to read all the way to the end to learn the key takeaways from my detailed analysis.

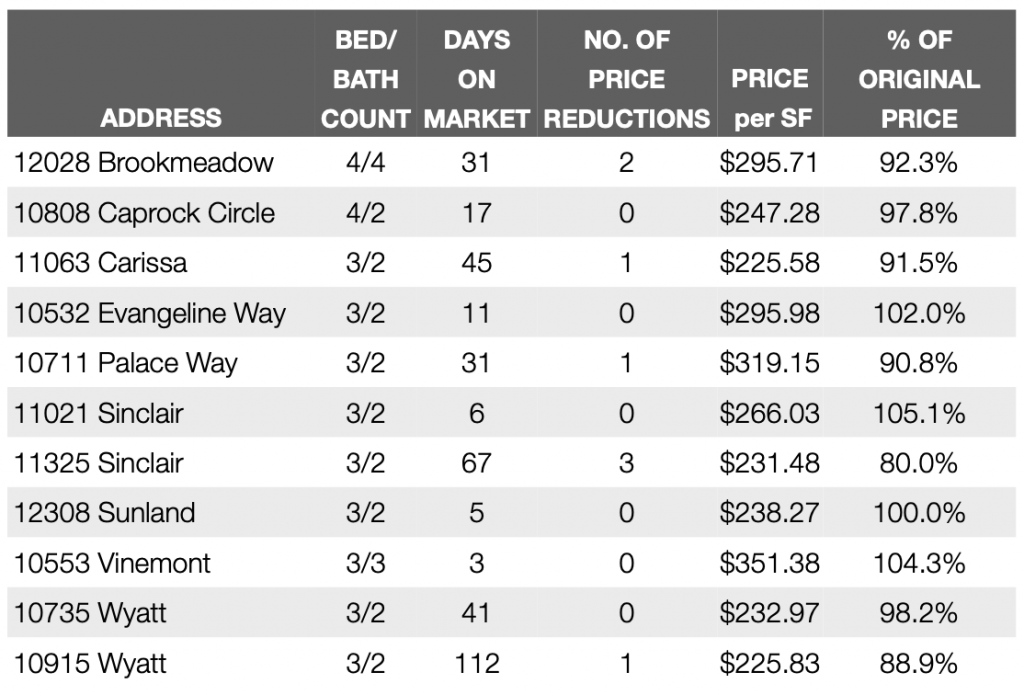

Looking Back: September Sales

The table below details all of the Lochwood homes that sold in September 2022. In all, there were 11 sales. Four of these homes sold for 100 percent or more of the seller’s original list price (far right column). For the purpose of comparison, there were 10 total sales and 9 of those homes sold for 100 percent or more of the seller’s original list price, in September 2021.

I have added a new column to this table this month: No. of Price Reductions. The reason I have included that information is because price reductions have become more common. Four of the 11 Lochwood homes that sold in September had one or more price reductions before going under contract.

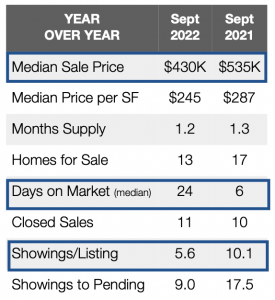

Looking Back: Year-over-Year at a Glance

The table below gives you a snapshot of how the market performed in September of 2022, compared to September 2021. The categories that I think are noteworthy are outlined in blue. Let’s look at Median Sale Price first. The reason there appears to be such a large drop is that many of the homes that sold in September of 2021 were larger and more updated, and many of them had pools. Homes that sold in September 2022 were smaller, had fewer updates, and none of them had pools. It’s like comparing apples to oranges. So that’s the real explanation about the drop in Median Price.

The other categories that are important are Days on Market and Showings per Listing. The number of showings have dropped by about 50 percent and that’s because fewer buyers are tolerant of todays higher interest rates. Many buyers have stopped their search and they think they will wait to buy until interest rates go down again. I have news for them. I don’t think that will be happening anytime soon.

Because there are fewer buyers looking to purchase a home, it takes a little longer for a home to go under contract. Year-over-year, days on market increased from 6 to 24. That’s really not too bad considering how much more expensive it’s gotten to borrow money, and it’s actually a normal timeframe for selling a house.

Other than the 3 categories that I highlighted, year-over-year numbers are quite comparable. We still have a very limited amount of inventory and the number of sales that closed was virtually unchanged.

What’s Happening Right Now? Pending and Active Listings

There are currently eight home sales pending in Lochwood. List prices for pending sales range from $292,000 to $639,000. Three of these listings had one or more price reductions before going under contract.

There are currently 10 homes listed for sale in Lochwood. Prices for these listings range from $400,000 to just under $1.3M. Six of these listings have had one or more price reductions. The price adjustments range from $10,000 up to $200,000. To view homes that are currently on the market, you can always visit the Lochwood Community Page on my website.

The new construction project on Lochwood Boulevard that was listed for $995,000 fell out of contract and the listing has been taken off the market. The other new construction project on Farrar was also taken off the market. Lastly, the new build at 10510 Swallow that’s listed for $1.275M did receive an offer within 10 percent of the seller’s asking price. Apparently, the seller responded with a counteroffer and the buyer just disappeared. Something tells me that buyer wasn’t very serious about buying the house. What a waste of time.

Key Take-Aways

-

- Year-over-year, the number of homes sold is quite similar. That’s encouraging given how much interest rates have gone up. It indicates that buyers are still very interested buying homes in Lochwood.

- Fewer homes selling for 100 percent or more of the seller’s original asking price indicates that there are fewer buyers competing to get these homes under contract.

- Price reductions indicate that sellers can no longer ask whatever price they want for their home. Buyers will wait for a price reduction so that the list price comes in line with what they believe the value should be and what they are willing to offer for the property.

- Our market has gone from 100 miles per hour back down to the posted speed limit. For the time being, with the information currently available, our neighborhood market appears to be normalizing.

- If you decide to sell your home in the near future, it’s important to work with someone who really has a pulse on the market. I’ve sold several properties in the neighborhood in the past few months and I know that sellers need up to date information so that they feel confident walking away from low ball offers. There is a lot of that going on right now.

- Because I have received low-ball investor offers on my listings, I’m pretty sure you’re getting calls from investors about cash offers for your home. I know for a fact that many of them do not offer true market value. If you are considering selling to one of these predators, please call me first. I will give you my honest assessment of what you would walk away with based on the terms of their offer, and how that compares to what you would walk away with if you put your home on the market. This assessment should give you the information you need to make a truly informed decision.

Now that you know what’s really happening with Lochwood home sales, you may also be interested in getting the full story about my listing at 10510 Lippitt. There’s no need to rely on what the neighbors have to say because I am going to give you the full story about how many offers the seller received, how many times it went under contract, and how the seller confidently told numerous buyers to take a hike.

Stay tuned in for that information in the coming weeks and contact me if you have any questions about anything real estate related in our great little neighborhood.

Be well,

Lochwood Home Sales and Market Update – Sept. 2022

Hello Lochwood neighbor! It’s that time of the month again. It’s time for your monthly Lochwood Home Sales and Market Update from me, Robyn Price.

This is the September 2022 edition of the update, which means that we will be looking at the Lochwood home sales that closed in August of 2022. I will also give you important information about the sales that are currently pending and listings that are active.

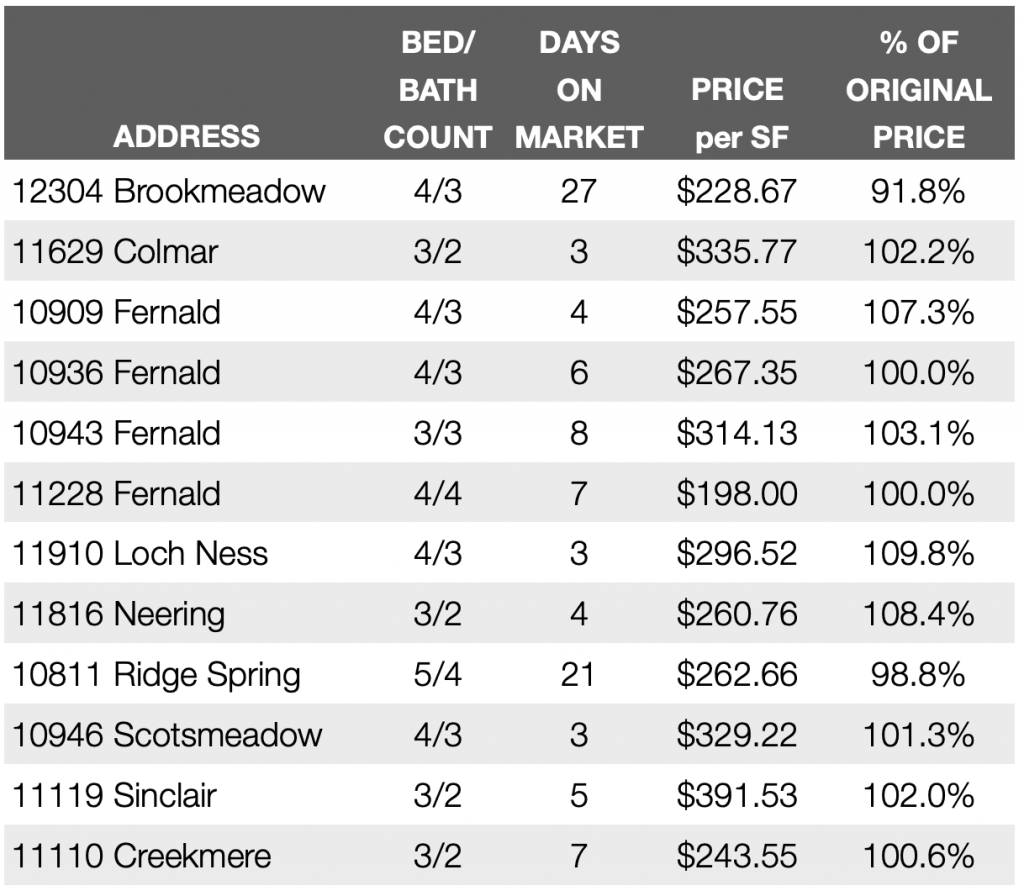

Lochwood Homes that Sold in August 2022

There were 11 total sales in August. Ten homes sold at 100 percent or more of the seller’s original list price. Three days was the shortest amount of time that a Lochwood home was on the market before going under contract. The maximum number of days was 27. Seller concessions totaled $41,000 which was 66 percent higher than the concessions offered in August 2021. Financial concession are often negotiated in lieu of the seller making any repairs. Concessions are a sign of the market has softened.

Complete list of the homes that sold in August 2022:

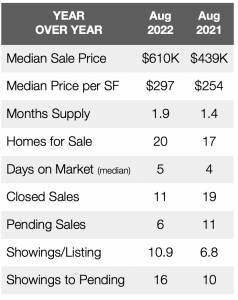

Year-over-year, there were a few more homes listed for sale in Lochwood, but not a significant increase. Closed sales dropped from 19 to 11, but showings went up. Interest rates were about 5.625 percent on a 30-year notes with 20 percent down. Perhaps active home buyers realized that they should take advantage of lower interest rates before they go up again in the near future.

Year-over-year comparison for August 2022:

Looking Ahead: Homes that will Close in September 2022

As of the writing of this blog on September 14, 2022, there were 10 home sales pending in Lochwood. If a home sale is pending, that means that it likely went under contract two to three weeks ago. Five days was the shortest amount of time that one of these homes was on the market before going under contract. The longest time on market was 124 days. Price reductions were more common among pending sales. Five of these listings (50 percent) had price reductions and the average reduction was $18,400. Price reductions are also a sign that the market has softened.

Currently Active Listings

There are 13 homes currently listed for sale in our neighborhood. The amount of time that these homes have been listed ranges from 5 to 124 days. Price reductions are the big story here. In total, 10 of these listings have one or more price reductions. Total dollar volume of price reductions was $576,000. Want to view the homes that are currently listed for sale in Lochwood? Click here 🙂

What Are the Key Takeaways?

- Price reductions have become more common. Sellers are learning to adjust to the market shift caused by higher interest rates. That being said, your home is still worth more than ever before. The rise in Median Sale Price is evidence of that.

- Price appreciation has slowed down but Dallas/Fort Worth still ranks third in the nation for appreciation. It is estimated that home owners have seen about 28 percent price appreciation this year. The MetroTex Association of Realtors reposted a great article from the Dallas Morning News about price appreciation. Click here to read it.

- Inventory remains very low so it is still a good time to sell your home! However, it is imperative that sellers understand that it may take a little longer for their home to go under contract. After all, there are fewer buyers shopping because of higher interest rates. It is also imperative that sellers have a plan in place if a price reduction is necessary. I wrote a blog about my recent sale at 2835 Lee Street. It addresses what the seller and buyer did correctly to get the property under contract. Click here to read that blog post.

That is all that I have for you today. As always, I hope you’ve found this information and assessment of market conditions in our lovely neighborhood helpful. I am always here to answer questions about your home, or any of the homes that have sold or that are currently listed in our neighborhood. Until next time, please be well and enjoy this cooler weather.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link

It is a fact that a lot of the housing stock in and around White Rock Lake is older. If you’re looking to purchase a home that’s turn key, meaning all of the surfaces have been remodeled and it’s move-ready, then you’re probably drawn toward homes that have been flipped.

It is a fact that a lot of the housing stock in and around White Rock Lake is older. If you’re looking to purchase a home that’s turn key, meaning all of the surfaces have been remodeled and it’s move-ready, then you’re probably drawn toward homes that have been flipped.