Selling the family home – Success story

I am an SRES, Senior Real Estate Specialist, which means that selling homes for older generations is a specialty of mine. I am now at the age where talk of selling the family home for mom and/or dad is becoming a regular occurrence among my friends and my own family. This is a blog about selling the family home, where my client grew up.

For most of us, our parents’ home holds a lot of memories. If it’s the home you grew up in, you probably remember playing in the neighborhood and where all of your friends lived. If it’s not your childhood home, you probably have memories of celebrating holidays and other special occasions there. You may have struggled for a while to find the next place for mom or dad. You may have had to twist their arm a little to get them to make the change. It makes complete sense that selling the home where you grew up can be very emotional.

I was referred to the seller of 12304 Brookmeadow in the summer of 2021. Her mother had passed in late-2020 and dad had been moved into an assisted living facility in the spring of 2021. It was a lot of change in a short period of time.

What’s my property worth?

The first question any seller asks is, “What’s my property is worth?” Generally speaking, I almost never discuss value when I do the initial viewing of a home. I may have a broad price range in mind but I prefer to assess the floor plan and visual condition before we start talking real numbers. During our initial visit, I learned that her parents had lived there since 1973 along with some other specifics about the house.

It’s pretty normal for people to accumulate stuff when they live in their home for nearly 50 years. I also understand that older generations do not have the throwaway mentality that younger generations sometimes lean toward. It never surprises me to see a lot of personal items in the home of an older person. I can look past it to perform an assessment of market value.

The seller and I met again the following day and reviewed the most recent comparable sales, potential sale price, market conditions, who would likely buy the home, and preparing the home for the market. At this time, buyers were paying a premium for almost any property they could get their hands on. Appreciation was rising rapidly. I knew this home would sell to an investor who would flip it because it was mostly original condition meaning, it needed some updating. My recommendation was to move quickly and take advantage of the red hot seller’s market. I advised my client to take the items that she knew she and other family members wanted from the home, and then to have an estate sale for the remaining items.

A Note About Estate Sales

Estate sales seem to evoke a very strong response from some people. It seems as though people are either all for an estate sale, or totally against it. For the seller of this property, she didn’t like the idea of other people going through her parents’ belongings. I get it but, here are some of the advantages to doing an estate sale. First, it saves the seller time. The estate sale folks literally organize, price and get everything in the house ready for the sale. Second, once the sale is organized, the home owner can go through and make sure they’ve not left anything of value behind. Third, they run the sale. The home owner doesn’t even have to be there. Fourth, after the sale, they will arrange for items that did not sell to be donated to charity. They will even coordinate pick up. Lastly, the homeowner makes a little money and the home is cleared out. Easy peasy!

Since this seller did not want to hold an estate sale, she began the process of clearing out her parents’ belongings while also working full-time, and frequently going back and forth to Houston to help transition her husbands’ parents to assisted living. Did I mention that she had a lot going on?

Moving from Just Listed to Just Sold

I followed up with her every couple of months and kept an eye on market conditions. In the spring of 2022, interest rates started going up. I could literally see buyers exiting the market and prices starting to level off. I told her that we had to move very quickly to get the house on the market and maximize value.

The house was listed June 24. I did not include photos of the interior because the house was not cleared out yet. Showings were limited for the first three weeks while the seller worked to clear out remaining personal belongings. Once it was cleared, interior photos were added to the listing. Showings picked up. The house went under contract to an investor/ flipper on July 21 and closed on August 16 for about 90 percent of the original list price.

Why the difference in list to sale price you ask? Because the buyer’s inspection found some deficiencies that were unknown at the time that the property was listed. This can happen with any home, especially a home that has not been occupied for over a year, and one that’s being sold by a trustee who hasn’t lived in it for over 20 years. Let’s be honest, not that many people get into their crawl space on a regular basis to to check for plumbing leaks or water damage. And, as long as a roof is not leaking or we’ve not had a recent hail storm, most folks aren’t getting up on their roof either. The only things seller and I could have done differently was to have the house inspected prior to listing it, and providing that information to prospective buyers.

Market Conditions

Changing market conditions also effected the sale of this property. Specifically, higher interest rates and slowing appreciation. It costs investors and flippers a lot more to borrow money than it does someone financing a home on a 30-year conventional mortgage. And when appreciation starts to slow down, investors get much more conservative about what they think they can sell the house for after it is remodeled. I mention this because I think it’s an important factor for anyone considering selling a home that needs updating.

At the end of the day, my client was pleased with the price that she got for the house and was happy to move on. I told her that we could go and take a look at the finished product when the remodel is completed. It made her feel good to know that a new family who would create their own memories would ultimately end up living there. As Sally Field said at the end of Steel Magnolias, “Life goes on!”

If your parents have been thinking about making a move, or if you’ve been putting off selling the family home, please contact me. I would love the opportunity to speak with you about how to best move forward.

Lochwood Market Update – August 2022

Hello neighbor! I hope you’re staying cool during this summer heat wave. It’s August 2022, and I hope you know that that means it’s time for another Lochwood Market Update!

Market Update

Last time I wrote, I asked whether the Lochwood market had peaked or not. Let’s take a dive into the sales that closed in July, and year-over-year numbers, to see if we can figure it out. Here’s your August 2022 Lochwood Market Update…..

Firstly, year-over-year numbers (chart below, left) were basically unchanged. The biggest changes are circled in red: fewer days on market before a home went under contract, and fewer pending sales, which could mean fewer closed sales for August 2022. We will have to wait and see!

Individual Sales

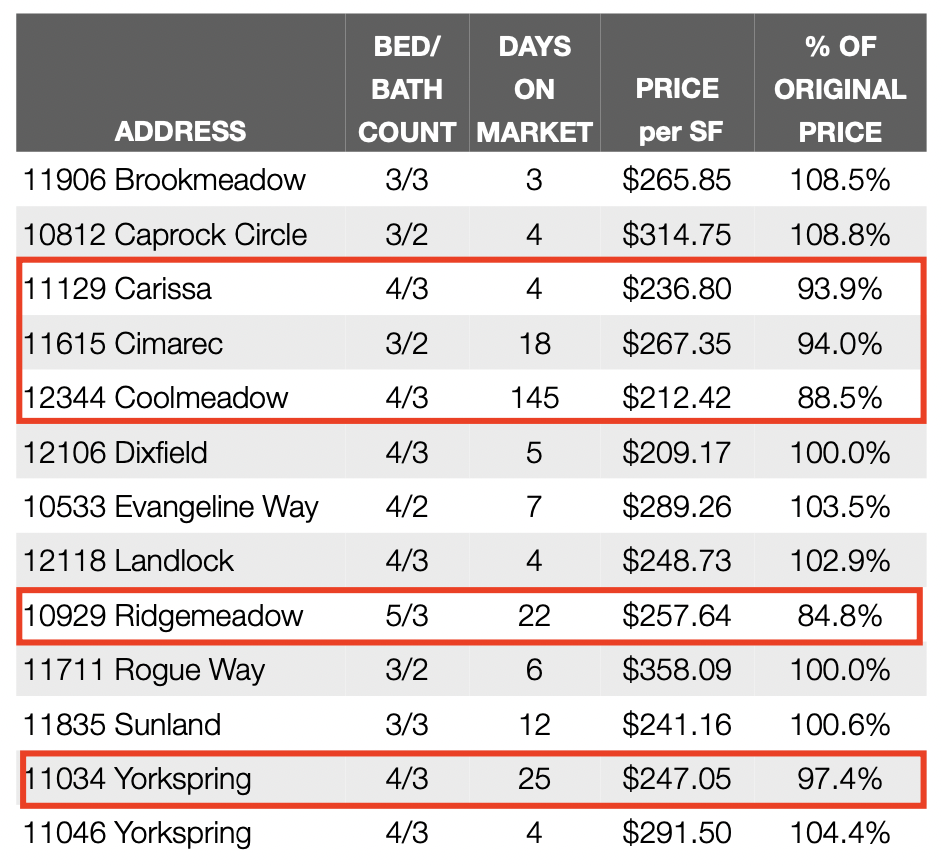

Individual sales for July are listed below to the right. There were 13 closed sales in all, and 8 homes sold for 100 percent or more of the seller’s original list price. Listings with the red box around them had higher days on market, had one or more price reductions, and ultimately sold for less than the seller’s original list price. The only exception is 11129 Carissa. It sold quickly, without price reductions, for less than the seller’s original list price.

The biggest change in the market is one that I do not track or report on a monthly basis: mortgage interest rates. The biggest change we’ve seen in the real estate market is the interest rate that buyers are paying to borrow money to purchase a home.

Yearly Comparison

In July 2021, the average interest rate for a 30-year fixed rate mortgage was below three percent. In July 2022 the average rate was 5.5 percent. What does that mean in terms of every day costs for home buyers? The median sale price of a home in Lochwood was $575,000 in July 2022.

Financed over 30 years, with 20 percent down at 2.75 percent in July 2021 equates to a monthly payment of approximately $3,300. Using the same price and terms for July 2022 rate of 5.5 percent equates to an approximate monthly payment of $4,000. That’s a 20 percent increase in a home buyer’s housing payment 😮

Conclusions

My takeaway from this information is that the buyers who are buying into our neighborhood are extremely rate-resilient. They likely realize that the cost of borrowing money is going to continue to rise as the Federal Reserve attempts to bring down inflation. They also probably realize that because inventory is still very low, home prices are going to continue to rise.

Do I think they’re going up 30 percent like they did last year? No, I do not. Do I think we could see lower-double-digit appreciation? Yes, I do, which is why it makes sense to buy now and refinance when rates go down next year or the following year.

Recession?

Since I’ve used my space on this blog and your time to talk about interest rates and the Federal Reserve, I would be remiss if I didn’t mention the R-word. You know, that word that keeps bouncing around among economists and the media….recession.

Firstly, how and when the word gets used largely depends on the results of economic data that been most recently released. For example, when they were talking about decreasing GDP a few weeks ago, they talked more about recession. When they talked about positive job growth last week, there was less talk of a recession.

Mixed Signals

The truth is, there are a lot of mixed signals coming from the economic indicators we traditionally use to assess the state of our national economy. But here are the things of which I am certain after working in DFW real estate for nearly 30 years.

First, if we do go into a recession, DFW homeowners will likely experience a limited impact. Home buyers are currently putting more money toward a down payment than they have in the past, and homeowners have more equity than they’ve ever had in the past. If there is a dip in housing values, people have equity, which means it will not see a fire sale on houses.

Secondly, our local economy will be a leading economy as we come out of recession. That has been the case for our last three recessions, and I do not see any reason to think differently if and when we slip into another.

Key Takeaways

I’ve thrown a lot at you today! Thanks for sticking with me. Here are my key takeaways:

- We are still in a seller’s market, but a lot of buyers have been priced out of the market, or chosen to exit the purchase market, so sellers are getting 1, 4, or 5 offers on their homes rather than 20 to 30.

- Homes that are priced correctly go under contract quickly and sell at or over the seller’s asking price.

- The cost of borrowing money to buy a home has increased and will continue to jump around based on the most recent economic data.

- Housing prices will continue to rise, but at a slower pace than 2021 because higher interest rates are eliminating some buyers from the market.

- It’s still a good time to sell.

- It is also a good time to buy. I’m currently advising my clients to marry the home and date the interest rate 😃

- Don’t try to time the market. Make a move when it’s right for you and your family.

That’s all I have for you today. I hope you’ve found it helpful and informative. If you’ve been thinking of making a move, give me a call. I’d love the opportunity to work with you!

I will be in touch soon!

In your service,

Lochwood Market Update – June 2022

Has the Lochwood market peaked? Well, it’s June 2022 now, so let’s have a Lochwood Market Update and see how it performed in May!

June 2022 Lochwood Market Updates

Year-over-year numbers indicate that there has not been a significant shift in our neighborhood market:

- Inventory is still very low. It is higher than last month, but it’s normal to see more houses listed in May, June and July.

- The number of days a home is on the market before going under contract is unchanged.

- Closed sales, pending sales and the number of showings on a house before it goes under contract are all very similar to last year.

- All the sales that closed in May were at 100 percent or more of the seller’s asking price (list price).

- Home sales that are pending (likely closing June 2022) were not on the market for very long before going under contract. This is typically an indicator that they will sell at or very close to the seller’s asking price.

The one big difference in the chart below is Median Sale Price. Sale price is where you see the biggest jump, and I don’t think that’s a big surprise to anyone. If you’d like a real life example of how quickly prices are appreciating in our neighborhood, read the blog I posted for the sale of 11720 Farrar.

Showing Information

Showings per listing peaked in February – right before interest rates started going up in March – and have declined for three consecutive months. Here’s how those numbers break down:

- February = 19.8

- March = 14.3

- April = 10.8

- May = 8.3

This indicates that fewer buyers are shopping. It’s likely that higher interest rates, which are forecast to keep inching up throughout the year, are causing some buyers to stop their search. However, the number of showings on a listing before it goes under contract are about the same as last year. It’s my opinion and experience that serious and motivated buyers are still out there looking and when they see something they like, they put it under contract.

Higher interest rates and fewer buyers (demand) do have the potential to put downward pressure on sale prices. That does not mean that I believe that home values will go down in the near future. There is still far too little inventory or supply for that to happen. These dynamics of interest rates, supply, and demand could cause sale prices to level off. This is what our market experienced in 2017, 2018 and 2019….a slower rate of appreciation.

Teardowns and Conclusions

A word on the “teardowns” on Farrar and Lochwood….because someone did ask for my take on it….

I know there is a lot of chatter in the neighborhood about not wanting McMansions in our neighborhood, and I am not going to comment on that one way or the other. What I will say is that buyers who want 3,000+ square feet of new construction, on our side of the lake, cannot get into it without spending at least $900K or more. Builders are building this type of housing because there is demand for it, and the higher prices go on the west side of White Rock, the more we will see people pushed to our side of the lake.

The one thing that the homes on Farrar and Lochwood have in common is that they were never put on the market. They were sold off market to builders, so home buyers and flippers never had a chance to bid on them. Do I think we will see more of them in the neighborhood? Yes, I do.

That’s my recap for now. I hope you’ve found the information and insight helpful. I also hope that you can see the level of detail I go to when advising my clients. Likewise, I make every effort to resolve “issues” before they arise and to make sure my clients have all the information they need to make the best choices for themselves and their family. Have a wonderful day!

If you have any questions or concerns, feel free to contact me!

I will be in touch soon!

In your service,

Family Life and Selling Your Home

When it comes to selling your home, it can suddenly feel like your life is a juggling act. Between keeping the house show-ready, ensuring your kids don’t feel like they’re living in a museum, and still having some control of your life, there’s a good chance you’re suddenly wondering if moving is the right thing to do.

Before you start to feel completely crazy and second guess your decision, there’s something you need to do…

Relax! There are ways to sell your home without sacrificing your mental health and family life. Here are four tips to get you started.

Keep It Clean, But Not Too Clean

The first step to selling your home without sacrificing your family life is to keep the house clean, but not too clean. You want potential buyers to be able to see themselves living in the space, which means getting rid of clutter and cutting back on the family photos you have around the house. It’s probably also a good idea to have the kids toys put away. Again, you want the potential buyer to be able to see themselves and their things in the home.

Don’t go overboard and make the house so sterile that it feels cold and unwelcoming. A few strategically placed personal items can actually make the space more inviting. Just be sure they’re things that have a broad appeal, like a nice vase or piece of art.

I have a perfect post describing some tips and tricks to keeping your home organized, so go take a look!

Set a Schedule and Stick to It

Another way to sell your home without sacrificing your family life is to set a schedule and stick to it. This means setting aside specific times for things like showings, open houses, and cleaning. Once you have a schedule in place, do your best to stick to it as closely as possible.

Of course, there will be times when things come up, and you need to deviate from the schedule. That’s perfectly normal. Just be sure to communicate with your family, so everyone is on the same page.

Keep Your Kids in Mind

If you have kids, it’s important to keep their needs in mind throughout the selling process. This means taking steps to make sure they understand what is going on, why so many of their items are packed in boxes, and why their toys need to be put away as soon as they’re done playing with them.

It also helps to have a list of places picked out that you go to when potential buyers are touring the house during a time that you would normally be at home.

Above all, try to keep things as normal as possible for your kids. This can be difficult, but it’s important to maintain some sense of normalcy during this time.

Don’t forget to take care of yourself

It’s easy to get so caught up in selling your home that you forget to take care of yourself. But it’s important to remember that this is a stressful time, and you need to take care of yourself, both physically and mentally. Make sure you’re getting enough sleep, eating healthy meals, and exercising. And if you start to feel overwhelmed, don’t hesitate to reach out for help from friends, family, or a professional.

Selling your home doesn’t have to be a stressful experience. By following these tips, you can sell your home without sacrificing your family life.

If you have any questions or concerns, feel free to contact me! I would be more than happy to help!

Just Sold Success Story – Lochwood

Congratulations to my clients, the Rosios, on the success of the sale of their Lochwood home. It was a pleasure to work with you both, and I look forward to doing it again at some point 😀

Here’s how we got to SOLD! …

The Lochwood Success Story

Late in the summer of 2021 the Rosios reached out to me to see what they could get for their home in Lochwood. They were interested in moving closer to work and needed a home that was a little bit larger.

We examined the most recent sales in the neighborhood, along with competitive listings in the area, and came to a price that worked for them. ✅

The Rosios wanted to purchase their new home and move into it before putting their existing home on the market. That meant finding a lender who had a loan product that suited their needs. I put them in touch with one of my go-to lenders, and although he couldn’t do their financing, he connected us with a lender who could. ✅

Searching For a Home

The search for their new home began! In October, we identified new construction in North Dallas, and met with the builder’s rep. Afterwards, we put their new construction home under contract. ✅

Once construction started, the building process actually went pretty quickly. Delivery and installation of the appliances is the only part of the process that delayed closing. However, their very creative lender was able to waive installation of all the appliances as a condition of closing, and the Rosios closed on their home. ✅

They moved in the next day. ✅

Staging and Selling

Two days later (Monday) my husband and his crew began the make-ready on their existing home in Lochwood. Wednesday afternoon the staging was installed. Yes, staging is still important in this HOT seller’s market. Thursday morning, the home was professional photographed. Yes, professional photography is still important even in this HOT seller’s market. Friday, around lunchtime, the listing went live in MLS. ✅ ✅ ✅ ✅

Eight days later, the home went under contract to an all cash buyer with a 3-week close (no, the buyer was not from California). ✅

If you’ve been trying to keep a pulse on the market and how quickly it’s moving or how rapidly home prices are appreciating, this part is for you…..

Eight days did feel like a long time for the house to go under contract. Especially when you’re accustomed to seeing homes on the market for one, two or three days. Nonetheless, it did go under contract, without any price reductions, to a very well-qualified buyer.

🧨Additionally, the price we came to in March 2022, about 2 weeks before the house was listed, was 27 percent higher than the price we determined at our initial meeting in late summer/early fall of 2021. That’s almost a 30 percent increase in less than a year.🧨

Key Takeaways

This concludes this Lochwood success story. Here are the key takeaways:

- Your home is worth more now than it has ever been in the past.

- There are financing solutions out there that can help you leverage the equity in your existing home so that you can purchase your new home before you sell. We just have to find the right lender and right loan product for you.

I hope you’ve enjoyed my Sold Success Story. I also hope that you’ll consider working with me if you decide that it’s the right time for you to make a move 😀

Lochwood Market Update – April 2022

Hello! How are you? Happy spring 🍀🌸🌧☀️. It’s already April 2022, so we all know it’s time for another Lochwood Market Update!

Market Information

Below you’ll find a year-over-year snapshot of the Lochwood housing market, along with a summary of the home sales that closed in March. Ten of the twelve sales that closed last month sold for 100 percent or more of the seller’s original asking price. The median number of days that a home was on the market before going under contract dropped from 14 days in March 2021, to only 7 days. The number of homes listed for sale was about the same, year-over-year. Much like other neighborhoods around Dallas/Fort Worth, prices were up considerably.

Looking ahead, I believe that April will be another strong month for the neighborhood. Overall, we will probably have about 10 home sales close, with an average of 10 days on market. STRONG! 💪

Housing Bubble Concerns

One thing that I keep hearing from my clients and neighbors is concern about a housing bubble. Wouldn’t it be wonderful if the people who reported on the housing market were actually experts and not just regurgitating what they read in a press release without any actual data to support the opinion? Let’s take a closer look…

In order to have a housing bubble, the market has to have the ability to do three things:

1) Lose value because of too much speculative inventory. Housing supply, whether it’s existing resale homes or new construction, is extremely limited.

2) Easy financing. In 2008, when the housing market crashed, mortgage standards were at an all-time low for credit scores and down payment requirements, as well as proving income and assets to purchase the home. Current mortgage guidelines are already pretty strict and will get even more strict, making sure that borrowers are financially secure and able to repay their loan.

3) Negative equity. Because there is limited supply, homes actually have equity. In 2008, homeowners were basically using their homes as ATMs and pulling all the equity out, causing them to be upside down. This time around, equity levels are extremely high, which means that an owner could see a slight decline in value without concern. That being said, the potential loss of value in our area is extremely low due to the lack of inventory and high demand for housing from our growing population and job creation.

Rising interest rates will cause some buyers to pause and rethink buying a home. The immediate impact will likely be that homes are on the market for two or three weeks before going under contract. However, as buyers realize values are not going down because of……you guessed it….lack of inventory….they will adjust accordingly and come back to the market.

That’s all I have for today. I hope you find this information helpful. Call me if you want a second opinion of your value assessment from the Appraisal District and be well!

I will be in touch soon!

Lochwood Market Update March 2022 + Property Taxes

Hello neighbor! It’s March 2022, so you already know it’s time for another Lochwood Market Update!

Market Information

The table below shows how the market has changed from February 2021 to February 2022. The median sale price has increased significantly. Some of that price increase is attributed to rapidly increasing sale prices. However, it is also because more than half of the homes that sold last month were, 2200 square feet or larger. In February 2021, only one of the sales that closed was a larger home. I hope that makes sense. If it does not, please call me and I am happy to explain! Supply or inventory held steady, and median days on market decreased to less than a week. Closed sales increased, and pending sales (sales that will close in March) were pretty much even. Bottom line, homes are selling faster and for more money than ever!!

The table below is a break-down of each home sale that closed last month. Once again, homes that were priced correctly sold within days and for 100 percent or more of their list price. Homes that were priced too high accumulated more days on market and ultimately sold for less than the seller’s original asking price. It’s kind of the same story, but a different day 🙂

Reminder / Conclusions

I’ll leave you with a reminder that you will soon receive your assessed market value from the Dallas Central Appraisal District. This is the value that they will use to determine your property tax liability for 2022. This is the value that you can protest and potentially lower your property tax bill. Once again, I am happy to help you determine whether the value that they’ve assigned to your property is accurate. I do this free of charge, every year, for any neighbor who asks. All you have to do is reach out via phone, email or text. You can reach me at 214.793.8787 or email me at robyn.price@cbdfw.com

I look forward to hearing from you! I will be back next month.

Be well,

Robyn

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link